Professor Okanga Boniface and Jennifer Davis-Adesegha

Edinburgh Napier University, Scotland

Abstract

Even if it does not render irrelevant the usually costly competition in the existing red markets, edifying effects of blue ocean investments are often still latent in a firm’s improved profitability, growth and returns on shareholders’ value. Usage of blue ocean strategy instigates the development and indoctrination of a culture of constant inquisitiveness and innovation. This edifies constant analysis of the unfolding trends and reconfigurations and modifications of the existing internal business capabilities to spawn an enterprise’s adaptation to new unfolding trends. However, quests for constant new value innovations are often constrained by unsupportive business behaviours, poor initiation or management of innovations, fear of managing extensive divestitures, and oligopolistic nature of certain firms that operate in less competitive and innovative markets. To encourage the use of blue ocean investments as a strategy for avoiding competition, and enhancing a business’ profitability, sustainability and growth, the study suggests a framework emphasising the importance for creating a strong culture of new value innovation as a pre-requisite for undertaking successful blue ocean investments.

Keywords: Blue Ocean Strategy; Businesses; Growth; Market Performance; Profitability; Sustainability

INTRODUCTION

Given the increasingly fierce competition of the 21st Century businesses, blue ocean strategy is certainly the new fortune generator. When Uber avoided fierce competition in the saturated US commuter taxi market, it did not take long before its newly created intra-city transportation App disrupted the entire global intra-city transportation system. Uber significantly lowered costs whilst also improving the ease and convenience of picking and taking customers from and to any locations of their choices(Uber, 2024; O’Connell, 2020). Capitalising on affordability, ease of use, safety and convenience as the unique selling propositions, Uber using blue ocean thinking was able to achieve immediate positive business results. In just a few years, Uber turned out to be the talk in major cities around the world.

Having been founded in just 2009, Uber was already by 2023 generating revenue of $37 Billion, net profit of $1.1 Billion and the overall market capitalization of $143.68 Billion. These imply as compared to competing in red ocean markets, blue ocean strategy is not only the instigator of revolutionary thinking and products, but also the undisputable business fortune generator of the 21st Century. When Canadian entertainment firms were engulfed in competition aimed at offering just the best discos and music festival events as the best entertainment services in 1984, Cirque-du-Soleil used blue ocean strategy and out-of-the box thinking to create circus as the new form of entertainment.

Circus that revolutionised the nature of entertainment industry is a form of entertainment service that brings together acrobats, gymnastics, art, music, dance, trained animal entertainment and other manipulated artists to create the form of outdoor entertainment services and products offered to the public (Klenk, 2019). Just like other blue ocean operators like Tesla, Southwest Airlines, HealthMedia and Netflix, the success of Cirque_du_Soleil signifies how blue ocean strategy is instrumental for bolstering superior market performance.

Usage of blue ocean strategy enables businesses discover new business ideas and new innovations for new markets that generate new sources of revenues, profitability and growth. A blue-ocean strategy is a strategic management philosophy that emphasises constant relevant analysis of the common factors of industry competition and customer usage (Kim & Mauborgne 2015). Through such analysis, businesses are able to identify unfulfilled needs and gaps that must be filled through new value innovations to unlock new uncontested markets that render irrelevant the competition in the existing markets.

The target of blue investments is often not to undermine rivals’ market performance, but identification and filling of new gaps that can enable an enterprise avoid the competition in the existing markets. Successful blue ocean investment leverages a business’ continuity by facilitating constant development of new businesses and abandonment of the less performing ones.

Even if the application of a blue ocean strategy does not necessarily create new uncontested markets; it can still induce superior market performance. It can instigate the development and indoctrination of a culture of constant innovation and inquisitiveness. This edifies constant analysis of the unfolding trends and necessary corresponding reconfigurations and modifications of the existing internal business capabilities to enable adaptation to such unfolding new trends. Such facts explain Apple’s high performing business capabilities. As Apple engages in the constant exploration and development of an array of new consumer electronics products that introduce new values for novel market needs, such innovative practices have led to the creation of a strong innovation culture (Podolny & Hansen, 2020). It is such strong innovation culture that has been instrumental for leveraging Apple’s market leadership and superior market performance.

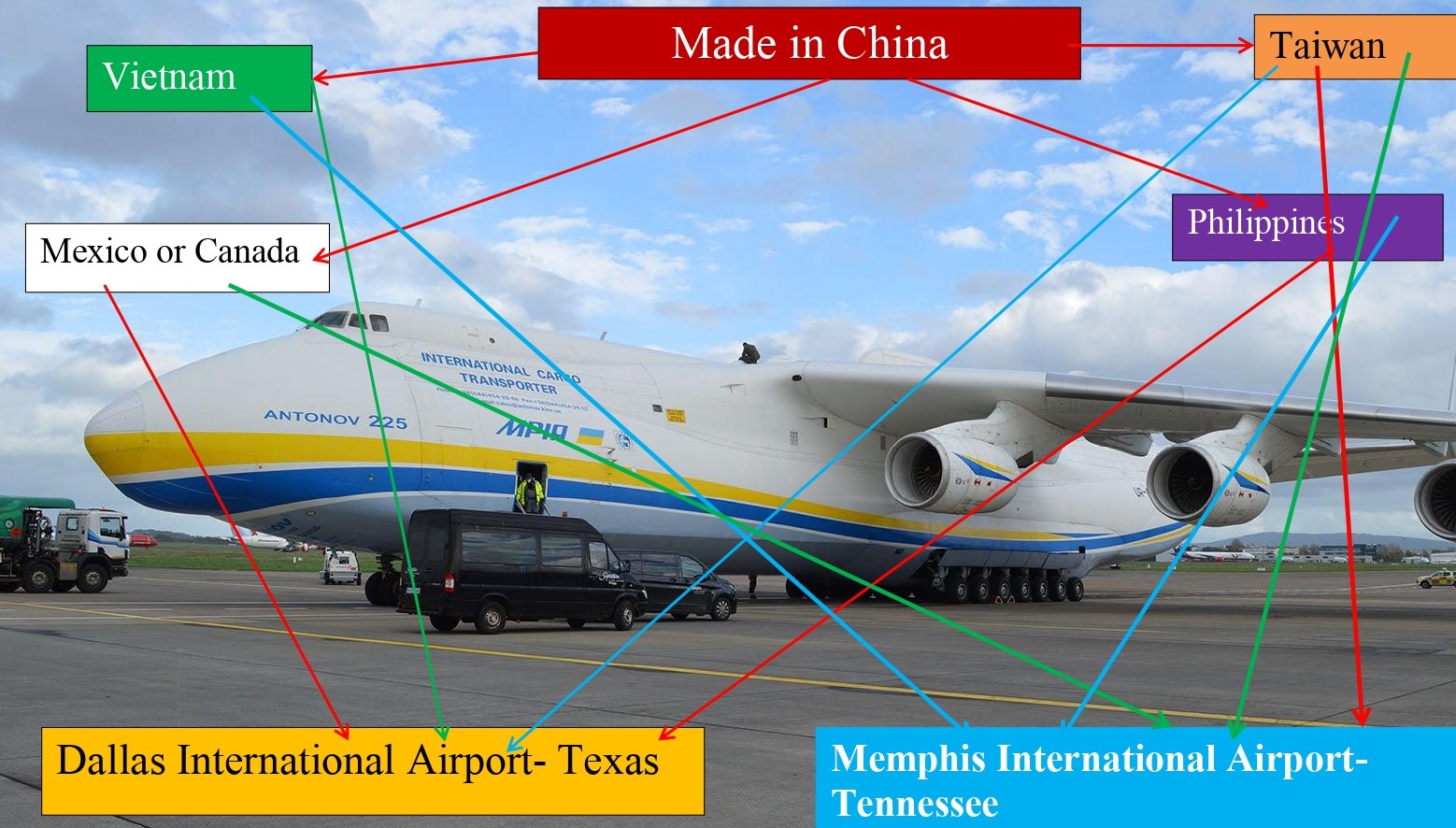

Constant quest for new uncontested markets through constant new value innovations may in turn not just create new uncontested markets. Instead it can also drive the improvement of a firm’s superior market performance. Depicted in the Intelligent Encounters’ (2024) video, most blue ocean abreast enterprises are often more inquisitive on how to innovate and adopt better cost-effective operational systems and methodologies.

In a bid to improve customer values, such firms are constantly conscious, searching and exploring how to influence the improvement of the level of resource optimisation. Directly, all these may translate into cost advantages that enable enterprises peg the costs of more superior quality products and services at prices that rivals cannot easily match. Besides edifying a firm’s cost competitiveness, it also impacts positively on differentiation. Constant impetus to outwit competition in the existing more volatile and discontinuous markets drive new value innovations. In effect, its positive business implications tend to get reflected in the improved product quality, features, attributes and functionality.

All these may improve a firm’s competitiveness on the basis of a bolstered level of customer focus. From these insights, it is quite evident that the use of a blue ocean strategy enhances a business’ sustainability. Businesses are increasingly embracing blue ocean strategy, but still it is not yet a widely embraced business sustainability concept among most of the firms (Kirsty 2016:9). Since most businesses instead prefer to use red ocean strategies by seeking to leverage their competitiveness in the existing markets, it is such a gap that this study addresses by evaluating how blue ocean strategy is effectively used to enhance a business’ performance in the increasingly discontinuous global markets. Through such analysis, the study aims to identify the major paradoxes and the corresponding hybrid remedial business model that can be suggested.

Blue Ocean Strategy

Conceptualised by Kim and Mauborgne (2015) and espoused in their book titled; “Blue Ocean Strategy: How To Create Uncontested Market Space And Make The Competition Irrelevant”, a blue ocean strategy is a unique corporate strategy that emphasises constant new value innovations to unlock uncontested markets that “render irrelevant the competition in the existing markets”. New value innovations refers to the constant process of analysing the prevailing and emerging new changes in customer needs, demands and requirements so as to respond by either innovating new products or modifying the existing product and service features and attributes to serve customer needs and demands presently ignored by most rivals (Andersen & Strandskov 2008).

Besides new product and service innovations, usage of blue ocean strategy may entail adding or subtracting certain product features and attributes to provide more benefits than the existing rival products or services. A critical analysis of the existing product and service features and attributes as well as its customer usage is therefore a pillar of the blue ocean strategy. It is the fundamental argument in the blue ocean strategy that focusing on how to leverage a firm’s performance in the existing markets may turn costly and unsustainable in the long-run(Okanga, 2017). Instead, by focusing on exploring and responding to new opportunities using constant new value innovations, firms are able to avoid the costly competition in the existing red markets and gain first-mover advantages in the new uncontested markets.

Kim and Mauborgne (2015:13) posit red markets to be analogous to perfect markets in which firms engage in cut-throat competition by constantly inventing new measures to drive down costs. Through such approach, firms aim to improve their cost competitiveness and sustainable superior performance derived from improved differentiation and customer focus. As firms develop new values and move into the uncontested markets, the proponents of blue ocean strategies argue that business values that a firm gains tend to increase as compared to if the firm had continued operating in the existing markets (Buisson & Silberzahn 2010:359).

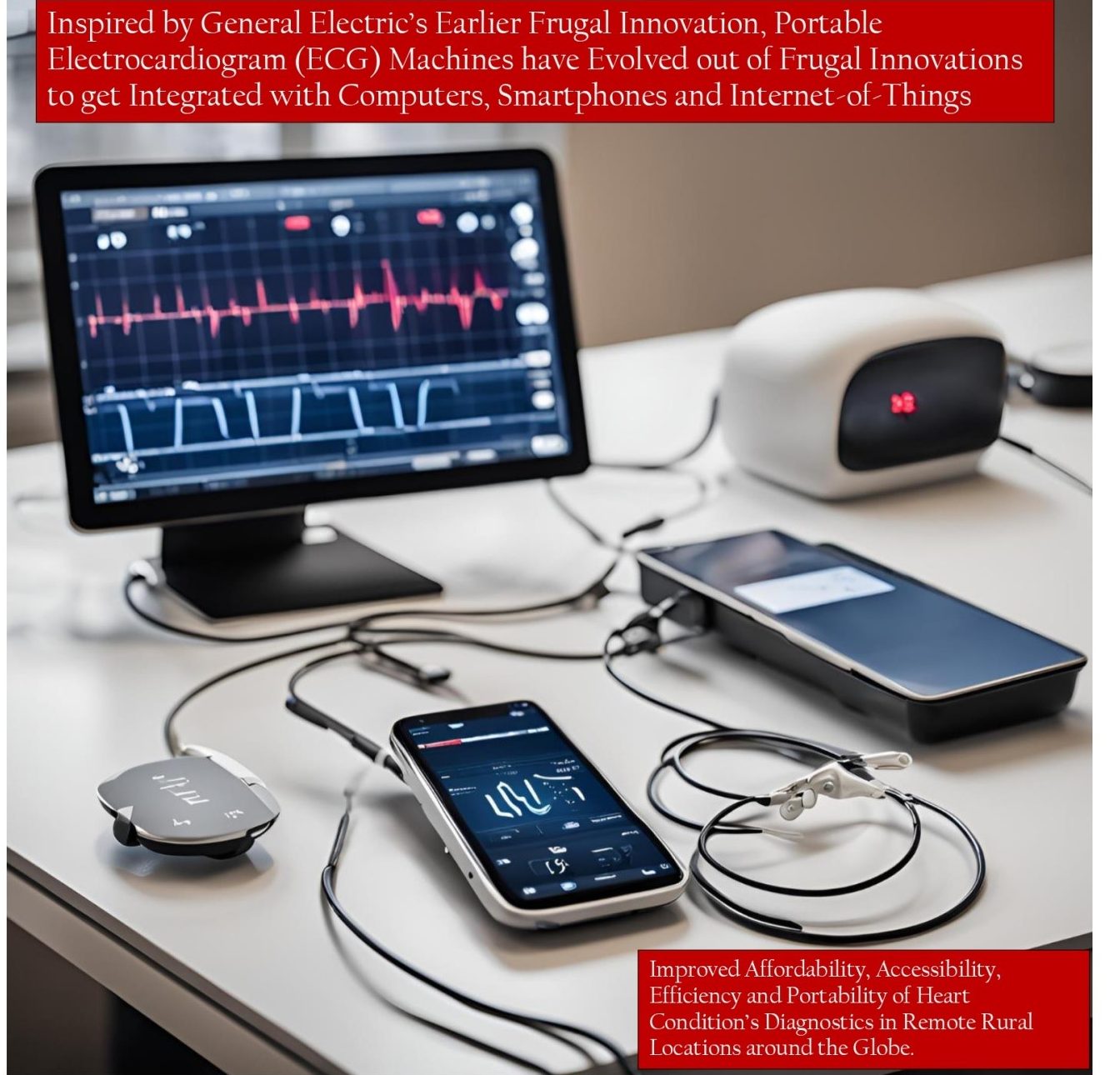

When HealthMedia realised that it could not withstand the fierce competition in the larger US healthcare counselling market, it created digital health coaching. Digital health coaching is a business model that offers online healthcare counselling, consultation and advise without necessarily requiring patients to visit HealthMedia’s facilities. The digital health coach business model was integrated with usage of telephone and other online technologies. This lowered costs whilst also responding to patients’ needs for convenience, ease-of-use and immediate healthcare response in the event of emergencies. In later years, this digital healthcare model became quite instrumental during Covid-19 response periods. However, that is not the only successful case of a blue ocean strategy.

In response to the saturated French banking market, Compte-Nickel used blue ocean strategy to create a banking system dealing only with the low income consumers and the other larger non-customers left out by the French traditional banking system. It’s simple and cost-effective approach for responding to the needs of the previously unbanked customers attracted even the middle income earners to disrupt the overall nature of the operation of the traditional French banking system.

This indicates how blue ocean strategy leverages a firm’s superior market performance. In addition to the ability to charge premium prices to gain significant profitability and returns on shareholders’ value, the other positive financial results often arise from significant reduction of the advertisement and marketing costs, and the cost of striving to differentiate products from rivals. The underpinning logic in blue ocean strategy however deviates from the conventional strategic management logic. It is the fundamental reasoning in the conventional strategic management thinking that for firms to thrive, constant analysis and scanning of the business environment are prerequisites for understanding the prevailing trends, as well as competitors’ actions and intentions (Barney, Ketchen & Wright 2011; Kiechel 2010; Porter, 1985; Teece 2007). This enables the modifications of a firm’s internal business capabilities to bolster cost competitiveness, and advantages arising from differentiation and improved customer focus.

Though such argument reflects the reality of how to thrive in the midst of turbulence and uncertainties unfolding in the modern business environment, recent trends imply new value innovation is still a driver of a business’ competitiveness and sustainability. New value innovation enriches a firm’s product portfolios, improves a firm’s overall financial bottom-line and returns on shareholders’ value (Banyte & Salickaite 2008:48; Boguslauskas & Kvedaraviciene 2009:75). Such trends are reflected in the video below to be illustrated in the development and evolution of Amazon as an innovation venture. Using approaches analogous to blue ocean strategy, Amazon evolved from just the humble beginning as an online bookseller to a multibillion dollar enterprise, engaging in the selling of a range of online assortments as well as invention of operational processes that delight customer experience to set it apart from rivals.

Unfortunately, empirical facts indicate that even for market leaders, there is often a stronger preponderance of the executives to compete in the existing competitive red markets than investing in new value innovations to unlock new uncontested markets (Kirsty2016:9; Love & Roper 2013:29; Moses, Sithole, Blankley, Labadarios, Makelane& Nkobole 2012:5; Ramukumba 2014:19). Yet, in red ocean markets, the fact that firms are often keen of the rivals’ motives, strategy, assumptions and capabilities so as to identify the likelihood of future threats limits the lucrativity of such markets (Andersen & Strandskov 2008:790;Kim & Mauborgne 2015:13). It also affects the sustainability of the businesses that are unable to attain superior market advantages over their rivals.

Firms operating in red ocean markets have to deal with the risks of vulnerability to price wars, costly aggressive advertisements, reduced profitability, rising operational costs and prices of inputs. High rate of factor mobility may also limit the sustainable use of valuable, unique, inimitable and non-substitutable strategic value resources and competencies to enhance competitiveness on the basis of cost, differentiation and focus (Burke &Van Stel 2009:219). As such high degree of cutthroat competition intensifies; the market turns bloody and diminishes opportunities for profitability and further growth. This limits the sustainability of most of the less capable firms. To enhance the undertaking of effective blue ocean investments, most of the proponents of blue ocean strategy agitate for the abandonment of the conventional logic in favour of the strategic value innovation logic.

Strategic Value Innovation Logic

As an innovative spirit is strongly ingrained in the development and application of blue-ocean strategy, strategic value innovation undertaken to create new values for uncontested markets often require usage of six steps/techniques encompassing (Debi2006; Kim & Mauborgne 2008):

- Abandonment of the conventional strategic logic

- Adoption of the strategic value innovation logic

- Use of strategy canvass, the application of ERIC (Eliminate-Reduce-Increase-Create) Grid

- Use of buyers’ experience and utility cycle curves

- Application of pioneer-settler-migrator map

Abandonment of the Conventional Strategic Logic

The strategic approach in the conventional strategic management logical is often to focus on analysing the prevailing trends. Through such analysis, businesses determine new strategic actions to be undertaken to minimise the identified threats and optimise opportunities whilst at the same time also undermining the competitors’ market performance. It entails the application of complementary strategies such as quality improvement and cost reduction strategies to pass cost advantages to customers through lower prices. Combined with the other value improvement strategies, all these influence the improvement of the rate of customer retention and loyalty (Debi 2006; Kim & Mauborgne 2008; Markides 2010). Besides striving to leverage existing assets and capabilities, it is also the strategic focus of the conventional strategic management logic to maximise the existing product and service offerings within the existing boundaries. Such approach limits the application of blue-ocean strategy that instead focuses on reshaping the existing industry conditions and boundaries through new value innovation.

To ensure the executives’ strategic management thinking and logic are supportive of blue-ocean investments, it is important to abandon the conventional strategic logic in favour of the strategic new value innovation logic. Instead of pursuing rivals, the strategic new value innovation logic aims at identifying and capitalising on the commonalities in customer values. It does not focus on customer retention and loyalty, asset and capabilities’ replenishment and leverage, but on the identification and capitalisation on the common solutions that customers seek within the existing industry boundaries, and beyond such boundaries and conditions (Debi 2006:29; Kim & Mauborgne 2008:14; Markides2010:62). It is such strategic thinking that induces the executives to evaluate the factors that must be added or subtracted from the existing values to create new values that unlock new uncontested markets. Engagement in such approach may require executives to use Strategy Canvass and ERIC (Eliminate-Reduce-Increase-Create) Grid.

Strategy Canvass and ERIC (Eliminate-Reduce-Increase-Create) Grid

The application of strategy canvass often enables identification of the factors such as product quality, pricing, marketing strategies, distribution and customer service quality that rivals compete on. These factors are compared with the ones that are often ignored vis-à-vis the degree of the importance that the customers attach to such factors or values (Parvinen 2011:10). This enables the executives identify gaps and opportunities, and evaluate relevant new value innovations that can be undertaken to fill such gaps (Yang 2012:701). The use of strategy canvass in such strategic process of thinking and rethinking is often aided by the application of ERIC (Eliminate-Reduce-Increase-Create) Grid to(Kim & Mauborgne 2008):

- Identify the values or factors taken for granted by the major industry operators that must be eliminated to reduce wastes and costs.

- The values or factors that customers attach less importance, but are still offered above the industry standards that must be reduced below the industry standards.

- The values or factors that customers attach significant importance, but are often offered below the industry standards that their standards should instead be elevated above the industry standards.

- The values or the factors that should be created to perfectly respond to the prevailing customer needs and demands, but that the industry has never created (Kim & Mauborgne 2015:13).To facilitate the understanding of whether the new values to be created perfectly respond to the unfulfilled customer needs and demands, the application of ERIC Grid is usually accompanied by the use of buyer experience and utility cycle curves.

- Buyer Experience and Utility Cycle Curve aids the analysis, mapping and understanding of the extent to which the existing customer needs and demands are effectively met by the existing product and service offerings.

It is through such analysis that further gaps in the existing industry are identified to further position new values in the way that fills such gaps and creates new uncontested markets. Buyer experience cycle curve uses six levers that include purchase, delivery, use, supplement, maintenance and disposal to map and understand factors that influence positive customer experience as they undergo the process of purchase and consumption of different products (Han 2008:361; Kim & Mauborgne 1997:102; Leavy 2005:13).Purchase facilitates the analysis of prices, quality, distribution and accessibility to the products and the quality of customer services that involve the interactions between customers and sales force during purchase.

Delivery entails the evaluation of whether products are delivered as efficiently as possible to customers. It requires the exploration of the lead time that it takes to deliver products as well as the use of multichannel deliveries such as in-store collections and third-party courier companies in the delivery of products. Usage examines customer experience involved in the use of the products. This is often accompanied by the analysis of the suitability of the supplements that are associated with the use of the products.

Supplements are the additional products or services that are associated with the consumption of the product. It is in the provision of supplements that there are often the tendencies for over-offerings that lead to wastage, costly operations and declining profitability (Han 2008:361; Leavy 2005:13). It assesses and identifies whether wastages exist to be eliminated to create new values that provide new customer experience about the usage and consumption of that particular product (Kim & Mauborgne 2015). Maintenance lever requires the analysis of the extent to which the functionality of the product can be easily maintained as cheaply as possible. Disposal lever is critical because it is through such analysis that the executives are able to identify whether new values can be created from such products. The use of buyer experience curve is often accompanied by the use of six utility levers that include customer productivity, simplicity, convenience, risk, fun and image, and environmental friendliness (Chang 2010:219). Once new values have been created and the firm is operating in new market, the executives often apply pioneer-migrator-settler map to assess the portfolios that are either getting stuck in the new web of the emerging red ocean competition or are still safe in the blue ocean markets.

Pioneer-Settler-Migrator-Map

Pioneer-settler-migrator map facilitates the assessment of the product or the service’s growth trajectories, and the extent to which the business is maximizing the values of the existing products and services whilst also creating new values for the future. Depending on the results of the analysis, the three platforms that can be used to further drive the innovation of new values include the product platform which is the physical product; the service platform which is the support system that encompasses maintenance, customer service, warranties, and training for distributors and retailers; and the delivery platform that includes logistics and the channel used to deliver the product to customers (Andersen & Strandskov2008; Kim & Mauborgne 2015).

Blue-ocean ventures are often continuous on the basis that once new waves of competition have caught up with the business in the blue-ocean, the executives must again create new blue ocean ventures. This signifies some critical success factors that the executives must pay considerable attention to include the executives’ strategic innovative philosophy, a culture of innovation, and financial resources for experimentation and marketing of new innovations. If well-managed, blue ocean ventures are usually associated with enormous profitability, growth and sustainability of the firm.

As reflected in AirBnB video below, usage of blue ocean strategy is an out-of-the box thinking initiative that may require just the evaluation of the existing conditions and resources to create and deliver products/services that were previously unanticipated by the existing industry operators.

Inadvertently, Airbnb used all the blue ocean strategy techniques. It abandoned the conventional strategic logic that holds that a normal hotel accommodation can just be established in the confines of what is called hotel or guest houses. This led to the introduction of novel thinking that hotel accommodation can also be easily created within one’s house or residence. In that process, Airbnb adopted the strategic value innovation logic by seeking to create value reflected in the adoption of guests’ accommodation model that significantly lowers the cost of accommodation.

Airbnb also used strategy canvass as well as ERIC (Eliminate-Reduce-Increase-Create) Grid to eliminate luxurious hotel accommodation features that guests do not want, reduce other hotel features that guests do not attached much value while increasing, creating and offering more of the values that hotel guests attach significant importance. By focusing on delivering core accommodation services which is just beddings and lighter morning breakfast, Airbnb used buyers’ experience and utility cycle curves to improve guests’ experience about the quality of its overall accommodation services. Though this indicates the value of blue ocean thinking, a challenge still arises from the extent to which most businesses are able to recognise the business significance of undertaking successful blue ocean investments.

Executives’ Decisions to undertake or not to undertake Blue Ocean Investments

Major edifiers or inhibitors of the executives’ decisions to undertake blue ocean investments are often explained by the entrenched business culture and practice, the oligopolistic nature of the business, innovation management, executives’ believe system and fear of extensive divestiture management.

Business Culture

A business culture founded on a strong innovative culture renders it easy for businesses to easily undertake blue ocean investments. A strong innovation culture contributes significantly to a business’ constant quest for new innovations and discovery of uncontested markets for growth. When innovation gets entrenched as a business culture, it turns into the practice that renders it possible for a business to easily find itself engaged in blue ocean investments. Unfortunately, only a few businesses tend to exhibit such a culture. Among most of the businesses, innovations leading to the development of new businesses for new markets are often feared for the risks of venturing into the unknown markets that their associated complexities are also largely still obscured. This leads to the development of a business approach largely directed towards the duplication or modification of the existing well known products or businesses other than the development of the completely new products or business concepts.

Most businesses fear committing resources on new ventures that no statistical and qualitative facts exist about the likely expected future returns. Most business executives feel confident and comfortable when committing necessary resources on the existing businesses because their risks and the reasons for their market failures and successes are often well-known. Such approach causes the development and introduction of the modified versions of the existing products to thereby spur further competition. As such situations occur, a culture that favours innovating new ways to improve competitiveness on the basis of cost, differentiation and focus often develops to divert away the attention of the executives from committing the necessary resources on new value innovations. In addition to such circumstances, the other determining factor depends on whether the firm is still in a perfect market condition or has already attained an oligopolistic status.

Oligopolistic Firms

Businesses operating in perfect market conditions may tend to become innovative and end up in blue oceans than the oligopolistic firms. Intense competition in perfect markets forces firms to become more innovative, and develop better operational methods and quality as the measures for improving their competitiveness against rivals in the existing markets. It is also most likely that it is the businesses in the perfect market conditions that may tend to explore growth opportunities in other markets through either horizontal or lateral diversifications.

As firms engage in such business approaches to outwit the competition in the existing markets, a culture of inquisitiveness tends to emerge among the executives. This is often accompanied by the development of the appropriate mindset about the importance to commit necessary resources on innovation, trials and experimentations so as to identify new products, business concepts and opportunities as compared to focusing on competing against their arch rivals. It is such conditions in the perfect markets that drive the improvement of innovation and the ability of firms to engage in blue ocean investments.

However, perfect market situations can also drive firms into two different circumstances. The first is that as the competition intensifies; firms may explore the other business opportunities and undertake new investments. The other condition is linked to the view that in the event of intense competition, more resourceful and competent big firms may engage in predatory activities to force rivals out of the market, thereby leaving such firms to gain oligopolistic status. As such firms gain oligopolistic status, blue ocean investments are often discouraged in favour of focusing and concentrating on maximising the opportunities in the existing markets. Such behaviours are reflected in the video below that indicates how failure to take advantage of a series of several emerging opportunities subsequently turned into one of the reasons leading to Yahoo’s failure and decline.

As such situations inhibit a business’ blue ocean investments, the other limitations often arise from poor innovations’ management. Innovations’ Management Even if the executives are committed towards ensuring that the company becomes innovative and blue ocean investment abreast, limitations would still arise from the management of the innovation process. Most businesses face the challenge of insufficient skills and talented scientists to play significant roles in new products’ conceptualisation, development, experimentation and testing before launching. With only a few skilled and talented scientists, most businesses opt to engage in just product modifications that do not involve innovations, but merely the duplications of the products existing in another industry and market if the competition in the existing markets turns unsustainable. Even among dominant market leaders, the tendency to be merely followers when it comes to new value innovations is often still constrained by lack of sufficient financial resources to facilitate the establishment of effective research and experimentation departments (Love &Roper 2013). For businesses that manage to successfully undertake blue ocean investments, it is often not easy to ensure that new innovations are successfully launched into the market. In most cases, new innovations are of superior quality and sometimes the best in the world, but challenges often arise from cost management during the conceptualisation and production of new products. The effect is that if the products are introduced into the markets, they are often quite costly for most low income consumers to afford. Though there are also cases, where new innovations have been successful straight away, other new innovations are often affected by poor cost and quality management. If product cost and quality are not a challenge, problems could arise from poor marketing and publicity of the product. Cost of marketing affects the extent to which new innovations can be effectively publicized and marketed to the larger markets. In effect, instead of using major televisions and newspaper media houses, most innovators often use a combination of internet marketing and one-on-one marketing. Test marketing may also be used through promotions, where the consumers are invited to test the products for free. With time, the use of such methods influences improvement of market awareness about the new product. However, they are still often less effective for changing the perception of a majority of the consumers to influence the increment of sales for the enterprises to generate sufficient revenues that can be used to recoup the enormous funds used in the process of research and innovations. As some of the firms undertake innovations successfully or fail to do so successfully, the executives’ believe may also not be supportive. Executives’ Believe In large enterprises that often have significant resources and potential to innovate and develop blue-ocean ventures, challenges are often arise from the executives’ believes about blue ocean investments. Some executives of most well-performing large enterprises often do not share the belief that blue ocean investments are critical determinants of a business’ sustainability. Some executives construe that even if a blue ocean investment unlocks a new market with significant profits and growth potential, such business opportunities and growth potential are often only temporary. High growth potential discovered in such new markets tends to lure more rivals and render new markets more competitive just like the previous markets. In effect, a question that usually lingers in the minds of the executives is as to why it makes business sense to continue innovating and leading other businesses into new business ideas and concepts, when in fact the company can also adopt the business philosophy of deliberately becoming followers. By adopting a business philosophy of a market follower approach, it becomes easier for the executives to enormously save costs required for research and innovation. As the business adopts a market follower approach; it may just tend to wait and adopt the business ideas of the leading innovators, modify and resell. It is such business thinking which is common among most of the businesses due to the fact that it is not because they cannot innovate and develop blue–ocean enterprises, but for reason that they just do not subscribe to the view that there is anything like blue ocean markets. As illustrated below in Xerox’s video, such situations are often further exacerbated by the fear of managing an extensive divestitures.

Divestiture Management

Blue ocean investments are often used by certain businesses as a strategy for diversifying into related and unrelated businesses and industries. Through such approach, most businesses aim to use blue ocean investments as the strategy for enriching their portfolio of businesses, and profitability to influence the improvement of the overall returns on shareholders’ values. In such circumstances, blue ocean investments are often strongly supported not only among the executives, but also shareholders. However, there are certain businesses with unique business philosophies. In these business philosophies, they tend to maintain only manageable operations and the operations that can be controlled. They also tend to adopt a business philosophy of maintaining stability by only focusing in the present industry and in the industry that they understand very well. In such circumstances, blue ocean investments that usually encourage wandering into the other unknown industries are often discouraged. Such blue ocean investments are discouraged not because of the fear that they can fail, but for the reason that the company does not aim to get involved in the management of more diversified and extensive structures.

Xerox was performing quite well and even developed computers before Apple could develop its first computer. However, due to fear and lack of a business philosophy that does not support extensive divestiture management, it avoided exploring the opportunities in the other industries. Instead it opted to focus on its photocopier technology, as it sold its computer innovation patents to Apple for just $1million. But in the end, Xerox regretted such business thinking and approach as the internet revolution introduced the capabilities of documents sharing and exchange without necessarily the need for printing or photocopying anything. Reasons for adoption of such business approach often arise from the fear of losing control of the activities of the existing business that may still seem more lucrative, and the risks of incurring exorbitant operational costs that may affect the profitability of the enterprise and the initiatives to improve shareholders’ value.

CONCLUSION

To survive and grow more sustainably in the increasingly more turbulent and discontinuous modern business environment, successful investment in the blue-ocean strategy is a prerequisite. Blue ocean investments edify constant innovations and improvements of the existing products. These improve sustainability and continuity of a business from one period of turbulence to the next. Through such innovations and improvement of the existing products, businesses are able to enrich their portfolio of businesses, insulate themselves against risks of turbulence and failures, and increase the overall enterprise’s profitability and returns on shareholders’ value.

Even if blue ocean investment does not result into the creation of novel products for new markets, it can still improve the business’ innovative capabilities. To enhance the successful implementation of blue ocean strategies and the attainment of such enormous business values, it is not only the integration of an innovative spirit in the development and the application of blue-ocean strategy which is often significant, but also the executives’ buy-ins, and the commitment of necessary resources in the research, experimentation and market testing.

The successful use and application of blue-ocean strategies may require businesses to develop and adopt a culture of value innovation. With a culture of value innovation, it can be easier for the executives to successfully undertake research and innovation that unlock new values and create new uncontested markets. The enforcement of a culture of innovation implies even the executives will recognise that the sustainability of their businesses will depend on the extent to which they are able to create new values for new markets.

A strong executive support will influence the allocation of sufficient financial and non-financial resources that can be used in research, innovation and the creation of new values. In addition to the availability of relevant financial resources, the executives that aim to create an innovative culture must also be able to develop and nurture a pool of talented, skillful and creative employees that are able to work in collaborative teams. With a strong innovative foundation, the business can instead of focusing on the weaknesses and how to beat rivals, assess how to create new values from the prevailing opportunities using the existing resources and capabilities. In that process, the business must also consider the need for the adoption of value innovation logic so as to create new values to attain a quantum leap, not just how to surpass rivals.

This can be accomplished by assessing and identifying the commonality in customer values that must be improved, not customer retention and loyalty, undertaking of assets’ rebirth, not leverage, and the adoption of new values exceeding the frontiers of the existing industry offerings, and not just a structuralist approach. The adoption of value innovation logic creates the foundation for the application of the ERIC Grid. Depending on the industry that the business operates, the application of ERIC Grid will require the executives to undertake four actions entailing:

- Eliminating the industry’s long cherished existing factors that have since turned valueless.

- Reducing factors of less significant values below the industry standards; increasing the factors of significant values above the industry standards.

- Creating new factors identified as critical, but presently missing.

Usage of ERIC Grid will certainly cause the business to develop new values and create a blue ocean market that renders competition in the existing market irrelevant. However, the executives must pay considerable attention to the fact that after the successful discovery of blue ocean market, with time, it turns into the red markets, as higher profits and enormous opportunities may lure more and more rivals to continue joining the market.

With a strong culture of value innovation that the business has created, it can become easier for the business to undertake a cyclical continuous process of value creation. In this circumstance, the executives can use pioneer-migrator-settler map to assess if the existing products or services are getting trapped in the emerging bloody red ocean competition. If the answer is in the affirmative, the executives can use three platforms; product, service and delivery platforms to drive further value innovation and avoid the emerging bloody red ocean competition. Given the value of blue ocean strategy for the contemporary businesses, future studies must continue how exploring how blue ocean strategy leverages profitability, growth and returns on shareholders’ value.

Extracted and Modified from Okanga, B. (2017). Leveraging Market Performance using Blue Ocean Strategies. Innovation & Strategic Management Review, 1(1), 52-76. Available from: https://www.researchgate.net/publication/362125730_Leveraging_Market_Performance_using_Blue_Ocean_Strategies [accessed Jan 16 2025].

Further Readings

Klenk, L. (2019). A Brief History of Cirque du Soleil: History of cirque du soleil. Ontario: Theatre & Life. https://www.theatreartlife.com/circus/history-of-cirque-du-soleil/

Uber. (2024). The history of Uber. https://www.uber.com/en-UG/newsroom/history/

O’Connell, B. (2020). History of Uber: Timeline and Facts. https://www.thestreet.com/technology/history-of-uber-15028611

Podolny, J.M., & Hansen, M.T. (2020). How Apple Is Organized for Innovation. Boston: Harvard Business Review. https://hbr.org/2020/11/how-apple-is-organized-for-innovation

Kim W. C., & Mauborgne, R. (2005). Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant. Boston: Harvard Business School Press. https://helenescott.com/wp-content/uploads/2014/01/BookReportBlueOceanStrategy.pdf